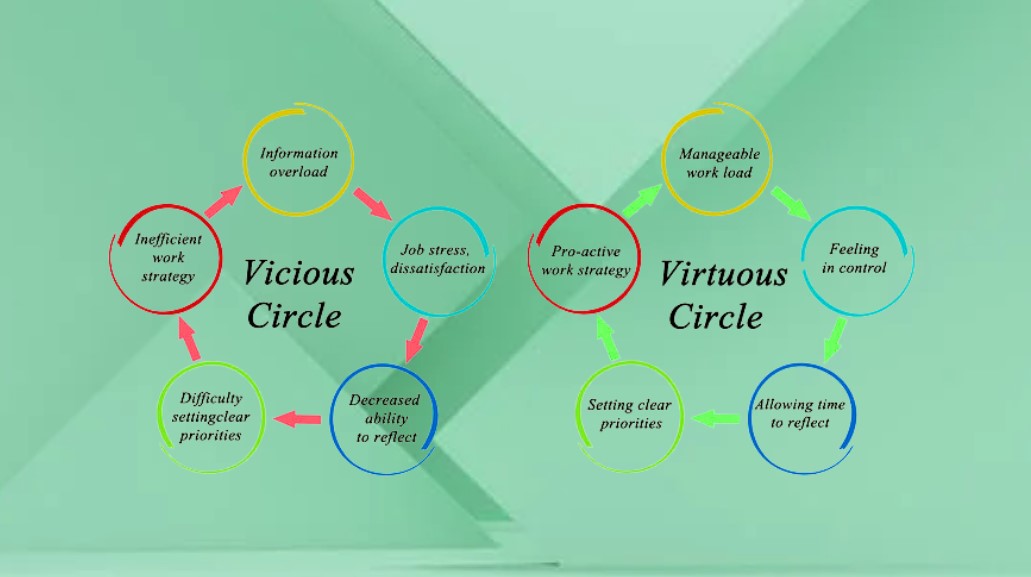

A virtuous circle is one where a good event feeds on itself to improve business further. It is a positive feedback loop. A virtuous circle can be small operating over days or it can drive a whole company’s strategy for decades.

The same positive feedback loop can also run in reverse however, to create a vicious cycle, when a bad situation feeds on itself to make it even worse. A feedback loop exists that reinforces the poor results.

When Is It Useful?

Virtuous and Vicious Circles are everywhere in business, under different names:

- Virtuous circles – Self-Fulfilling Prophesy, Snowball effect,

- Vicious circles – Doom Loop, Slippery Slope, Death Spiral, Domino Theory, “Thin end of the wedge”

It is a key component of systems thinking – reinforcing loops. Your business environment includes hundreds of virtuous circles and vicious circles – operating at economy, industry, company, strategic, department, teams or even within an individual’s head. They operate on cycles of decades, years, months, or even days.

Harnessing even one virtuous circle can form the foundation of a successful strategy.

An Example?

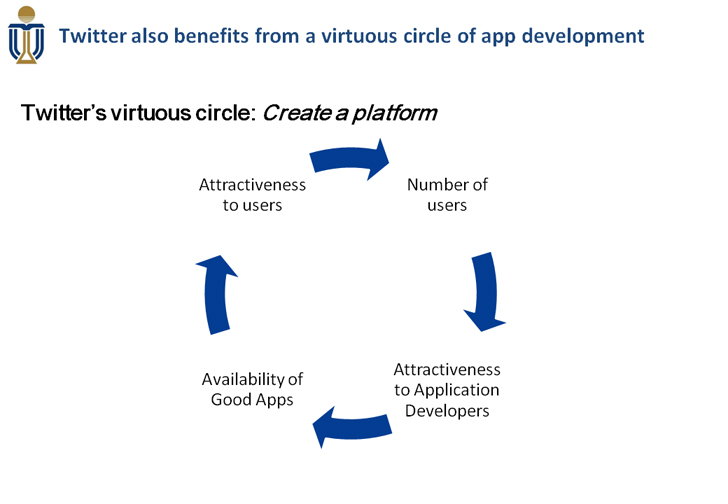

If you want to create a two-sided marketplace or a “platform”, you will have to think about how to create a virtuous circle of liquidity.

The more users Twitter has, the more economically attractive it is for application developers. If good developers are attracted to the platform and build good apps, it will be more attractive to users. This “Network effect” means growth strengthens the value propositions to both sides of the marketplace.

This feedback loop will drive Twitter growth.

“Chicken and Egg” strategy problems can be thought of a trying to find how to get a virtuous circle rolling.

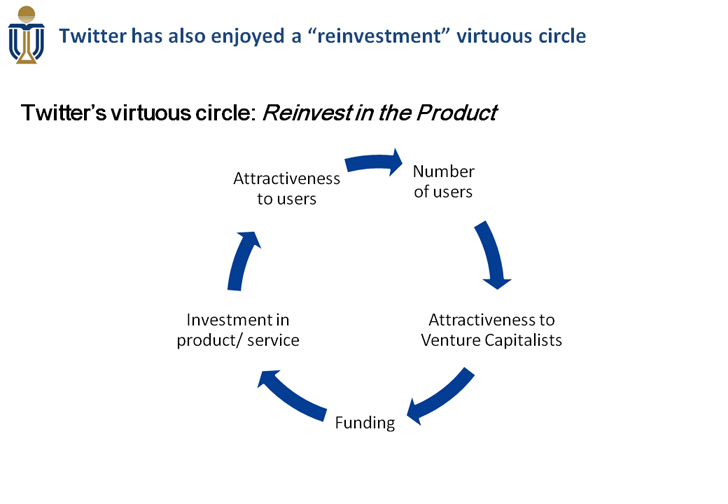

Another frequently encountered virtuous circle is from re-investment. If Twitter invests Venture Capitalist funds in its product, it drives growth and its user base makes it even more attractive to raise funds.

There are many different reinvestment virtuous cycles. The investment could be made in marketing, salaries, R&D, price. The critical insight is to keep reinvesting; pulling investment out could turn the virtuous circle into a vicious circle.

Investment is withdrawn, cheapening the product, which reduces sales and profits, leading to even more investment being withdrawn to maintain short term profits.

Network effects are a special example of a virtuous circle, when adding customers increases the value proposition for future customers.

I Want to Know More

Read “The Fifth Discipline” by Peter Senge

Jim Collins, Good to Great

How Can You Adapt This Concept?

Doom Loop is another term for a vicious cycle, where an attempted solution just makes the situation worse because of the underlying system.

In a common retail example, same store sales are falling. In response, management steps up the intensity of promotions. This has a temporary impact, but whenever the promotions end sales return to free fall, faster than before. Management accelerate promotions again, until operations can’t handle it and the supply chain breaks down.

The Doom Loop occurs when a superficial solution is chosen, without an understanding of the underlying problem. In the retail example, the real problem could be that the store could have lost it’s differentiation in customers eyes, and cluttering it up with price-based promotions just increases this perception. The short term solution just made the fundamental problem worse.