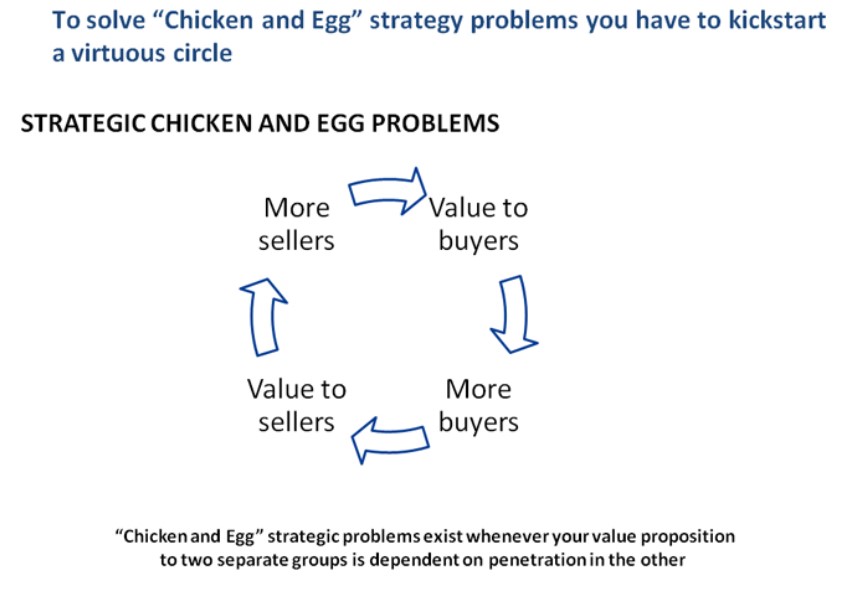

Chicken and Egg strategy problems occur whenever the value proposition to two separate groups is dependent on penetration in the other. An example is an auction site like eBay, with the number of buyers driving attractiveness to sellers, and likewise the number of sellers driving attractiveness to buyers.

This situation will power a virtuous circle once an attractive offer to both groups has been created- “liquidity” has been achieved.

The chicken and egg strategy problem is how to get this “network effect” started when you have neither buyers nor sellers. The creation of every “platform” business or two-sided marketplace requires a Chicken and Egg strategy problem to be overcome.

When is it useful?

You will spot Chicken and Egg strategy problems in market entry, start-up businesses, and the creation of “platforms”.

Run through the solutions that have been successfully used before in order to get ideas for how to solve yours.

How do you do the analysis?

Identify chicken and egg strategy problems by mapping out the value propositions to the different stakeholders you need. When you spot ones that are dependent on other stakeholder penetration, go – aha, chicken and egg strategy problem!

Then you can run test the proven solutions to chicken and egg strategy problems to see if they will work for you:

1. Bribe the chickens

You can persuade one group to sign up in advance of penetration in the other group by paying them an economic incentive. Normally an option only available to big companies can get expensive, but it is a way to get the virtuous circle going fast. This would be particularly important in a winner-takes-all market with competitors chasing you.

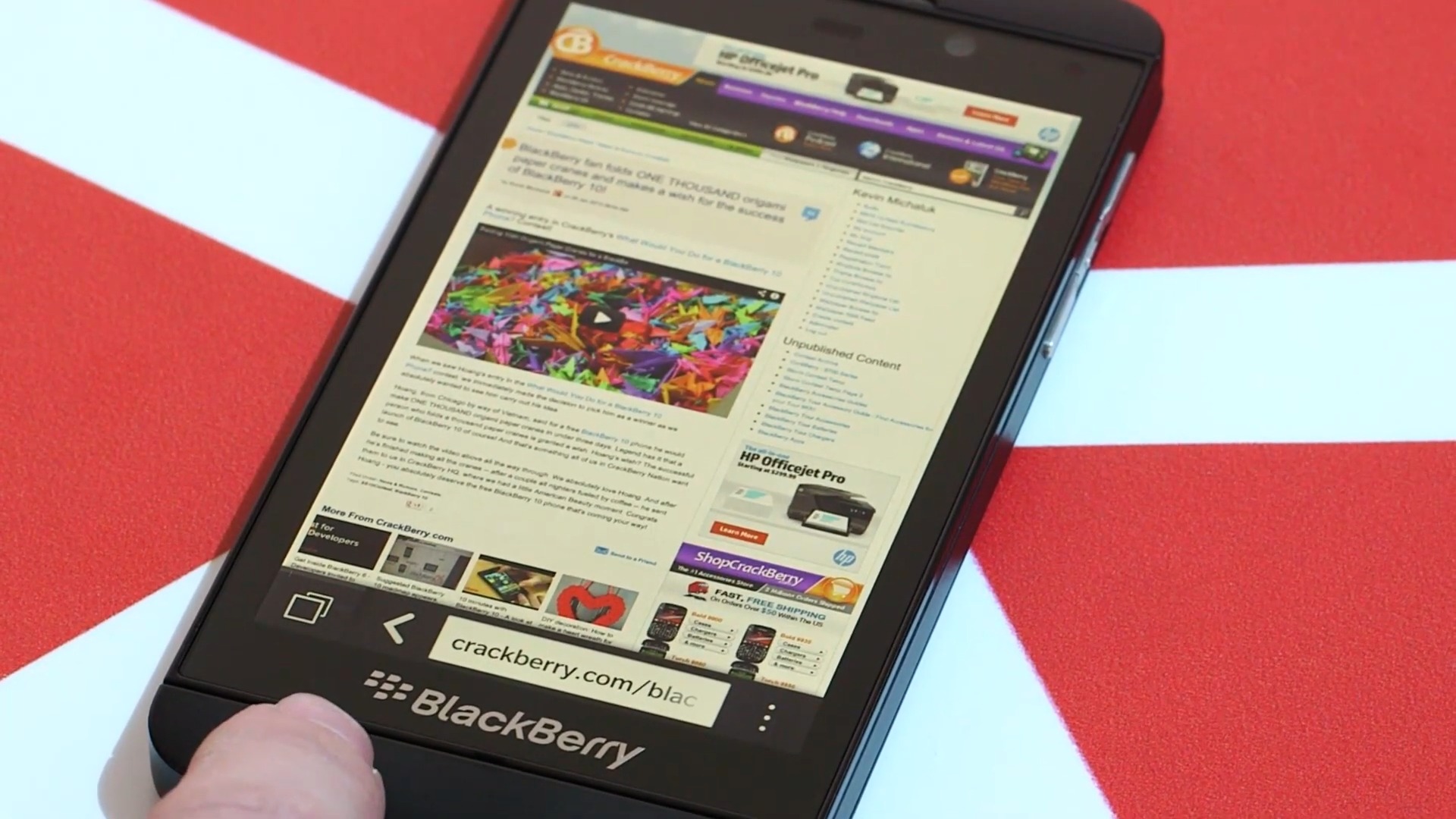

A classic software platform example is the Chicken and Egg problem that killed the Blackberry smartphone. Without an installed base of smartphones, the economics of a developer launching an app for the Blackberry operating system was much worse than developing for Android or iOS. So all the good developers make for these, leaving only bad developers and apps for Blackberry. Launching with a poor selection of apps guarantees that the phone will not sell well, so Blackberry never builds an installed base.

RIM tried the “bribe the chickens” solution to solve this, guaranteeing every developer for the Blackberry 10 at least $10,000. However, think this through – is this guarantee likely to attract the best or the worst developers? The best will still want the opportunity to make 100 times this on iOS or Android, it is only attractive for the worst developers.

A Printer Company trying to secure shelf space for ink cartridges for a new launch has this problem. Until there are many printers sold, there is no demand for cartridges. However, if replacement cartridges are not easily available in many stores, it is not very attractive to buy the printer. This can be overcome by paying listing fees to the retailers to stock the product before the demand comes through.

A new ETF (Exchange Traded Fund) faces this liquidity issue. Until it is broadly traded, the bid-ask spread will be high, making it unattractive to investors. However, once it is traded frequently in-depth, the bid-ask spread will be reduced and it will become attractive. Thus the famous virtuous circle “liquidity begets liquidity” is created. Fund issuers recruit (pay!) market-makers to create this liquidity for their equities in the early days.

A nightclub can be thought of as a two-sided marketplace. Its platform strategy requires careful management of liquidity. In fact, one of the main skills of the doormen in to maintain the right balance in the club. Men are attracted by the presence of stunningly beautiful women, and stunningly beautiful women are attracted by the presence of the right sort of man, coupled with other incentives like “ladies go free” nights.

2. Have a compelling offer to the chickens without the egg

Google built up YouTube as a stand-alone value to posters without any way for them to profit from it. Once they had a large base of eyeballs, they introduced ways to commercialize the videos through advertising and paid-for channels/content.

3. Tap into an existing flock of chickens

How did MS-Dos win? It wasn’t even the best operating system available for PCs. But it had one secret – it was designed specifically so that the most popular word processing application of its day, WordStar could run on it, even though WordStar was designed for an earlier operating system. The advantage? MS-Dos had good software available on the day it launched, but competing systems were never able to catch up.

If you are building a software platform, backward compatibility is your lifeline – don’t leave home without it.

Tapping into an existing flock was also the solution for Threadless. Threadless is a platform for the creative design of T-shirts – users create designs, upload them, vote on winners, and then buy them. All the Threadless platform does is curate the community and fulfill the orders for winning T-shirt designs. Like any platform, it has the challenge – how does it attract people to upload designs before it has members to buy and vote? And why would members come before there are attractive designs?

One critical factor in Threadless’s success was that it grew out of an online discussion forum for designers. Therefore there was already a deep and talented pool of designers present, even before the opportunity to see their work produced for real was set up.

4. Start with a very very small chicken and a very very small egg

Creating liquidity at scale can be daunting. However, you only need to create liquidity in a small segment of the market for the virtuous cycle to work for you, not against you. Once you have the virtuous circle moving, even in a tiny market, you can extend to adjacent markets, leveraging the liquidity you have already created.

This was how eBay grew. Although the story that it was started by Pierre Omidyar to help his girlfriend find the Pez Dispensers she collected has been revealed to be a PR invention, it did start out with its heartland in obscure collectibles with no alternative trading platforms (obscure collectors are too geographically scattered for sores to be viable). Once it built liquidity in these areas, it had the eyeballs to direct to more mainstream product lines – cars are now one of its biggest lines.

5. Sell to someone with both chickens and eggs

How would you sell the first fax machine? Not very useful until you have someone to send to! The history of how fax machines developed shows one solution to the “chicken and egg” strategy problem. In the 1920s, newspapers started using faxes since they were the only way to transmit photos for the front page.

Fax salesmen could sell a newspaper an entire network with multiple fax machines at once, overcoming the lack of value before the “network effect” kicked in. Looking at how its fax penetration rose, we can see them penetrating successive private networks – the military, and weather charts.

Then post WWII, faxes broke through to mainstream in one country first. Competing transmission technologies were not good at sending Japanese kanji characters. Once mainstream in one country, the network effect drove them to a global scale.

Another current example is electric cars. Until the infrastructure to charge electric cars is widespread, the appeal of the cars will be limited to a niche due to the inconvenience and risk of running out of power. However, until there are many electric cars on the road, the economics of running charging stations will be terrible. Applying the “sell to someone with both chickens and eggs” solution, Tesla should find someone who can buy the entire ecosystem all at once – a city municipality or a car rental company.

How can you adapt this concept?

There are other versions of the chicken and egg in other aspects of business that could be called “Catch-22” after Joseph Hellers classic book.

For example, when your company is struggling for cash, no bank will lend to you – they are waiting until you no longer need the money when they will be very happy to give you all you don’t need.