For small business owners, setting up an effective payroll schedule is key to keeping finances in check and employees happy.

One popular option is biweekly pay, which strikes a good balance between regular paydays and easy-to-manage payroll processes.

Choosing biweekly pay comes with several benefits, like better cash flow management and less time spent on payroll processing.

Reasons to Opt for Biweekly Payroll

Advantages for Employers

Adopting a biweekly payroll system can offer numerous advantages for your organization. Enhanced cash flow management is a key benefit, as spreading payroll expenses across more pay periods helps balance finances more effectively. Instead of facing large financial outlays once a month, you can plan expenditures more steadily, aiding in budgeting and financial forecasting.

Additionally, streamlined payroll procedures can lead to efficiency. Processing payroll every other week reduces the number of transactions compared to a weekly pay schedule, cutting down on administrative workload. This efficiency allows your HR department to focus on other important tasks.

Furthermore, offering a more frequent payment schedule can heighten employee satisfaction, potentially increasing retention rates. When employees receive their pay more frequently, it can lead to higher morale, as financial stability usually enhances job satisfaction.

Biweekly pay schedules also assist with regulatory adherence, particularly in states like California, New York, and Massachusetts, where pay frequency is more tightly regulated. Ensuring compliance with these laws protects your business from potential penalties.

Finally, a biweekly payroll system can offer simplified record maintenance. With consistent payroll intervals, maintaining and auditing records becomes more straightforward, aiding in documentation management and legal proceedings.

Advantages for Staff

For employees, the biweekly payment system provides several perks. Receiving paychecks every two weeks can significantly aid in personal budgeting and financial planning. More regular cash flow helps individuals manage their money better, reducing short-term financial pressure.

Moreover, receiving pay frequently allows better alignment of income with regular financial obligations, making it easier to handle bills. Regular disbursements mean that individuals can align their pay with monthly expenses more easily, reducing stress and avoiding late payment fees.

Having more frequent opportunities to receive money can also encourage better savings habits. Employees may find it simpler to put aside small amounts regularly, which can accumulate significant savings over time.

The regularity of biweekly pay contributes to greater financial security. Without the need to rely on credit for short-term needs, employees can better manage their financial health, promoting a more stable economic environment for themselves.

Finally, consistent pay schedules contribute to higher morale and job satisfaction among staff members. Knowing exactly when to expect their next paycheck supports a positive work environment, fostering a more motivated and committed workforce.

How to Introduce a Two-Week Pay Cycle in Your Company

Use a Payroll Software Solution

This software can automate and simplify payroll processing, ensure accuracy, and keep you compliant with federal and state regulations. When selecting a system, look for one that supports two-week payment cycles and can integrate seamlessly with existing company systems like accounting software.

Consider features such as automatic tax calculations and time-tracking integration as added benefits. Compare different providers carefully, evaluating both cost and offered features to make a well-informed choice. It might be worthwhile to spend a bit more to ensure you have a robust system that meets your specific needs.

Familiarize Yourself with Legal Obligations

The Fair Labor Standards Act (FLSA) mandates that non-exempt employees must receive their wages, including overtime, at least biweekly. It’s equally important to review state and local laws, as some regions require more frequent payments.

For example, some states might require payment at least twice a month, which could influence how a two-week pay schedule is implemented. Understanding these nuances can help avoid legal complications.

Engage in Open Dialogue with Your Employees

It’s important to gauge their opinions and see if this change aligns with their expectations and preferences. Conducting an employee survey can provide valuable insights into how your team feels about this potential shift.

The survey should ask about their satisfaction with the current pay schedule and any concerns or preferences they have regarding pay frequency. Once feedback is gathered and analyzed, you can decide if a biweekly schedule will be well-received.

If you choose to move forward with the change, educate your employees on the new pay structure. Providing training sessions or informational materials can help ease the transition and ensure everyone understands the adjustments.

Shift from Your Present Pay Schedule

With the planning complete, transitioning from your current pay cycle to a biweekly one requires careful execution. Develop a detailed timeline that outlines each step of the transition, including key milestones and deadlines, to ensure a smooth process with minimal disruptions.

Communication is key. Announce the upcoming changes well in advance, clearly explaining what will happen, when it will occur, and any effects it might have on employees’ paychecks. Another strategy to consider is piloting the new pay system with a small group before full implementation to identify potential issues early and make necessary adjustments.

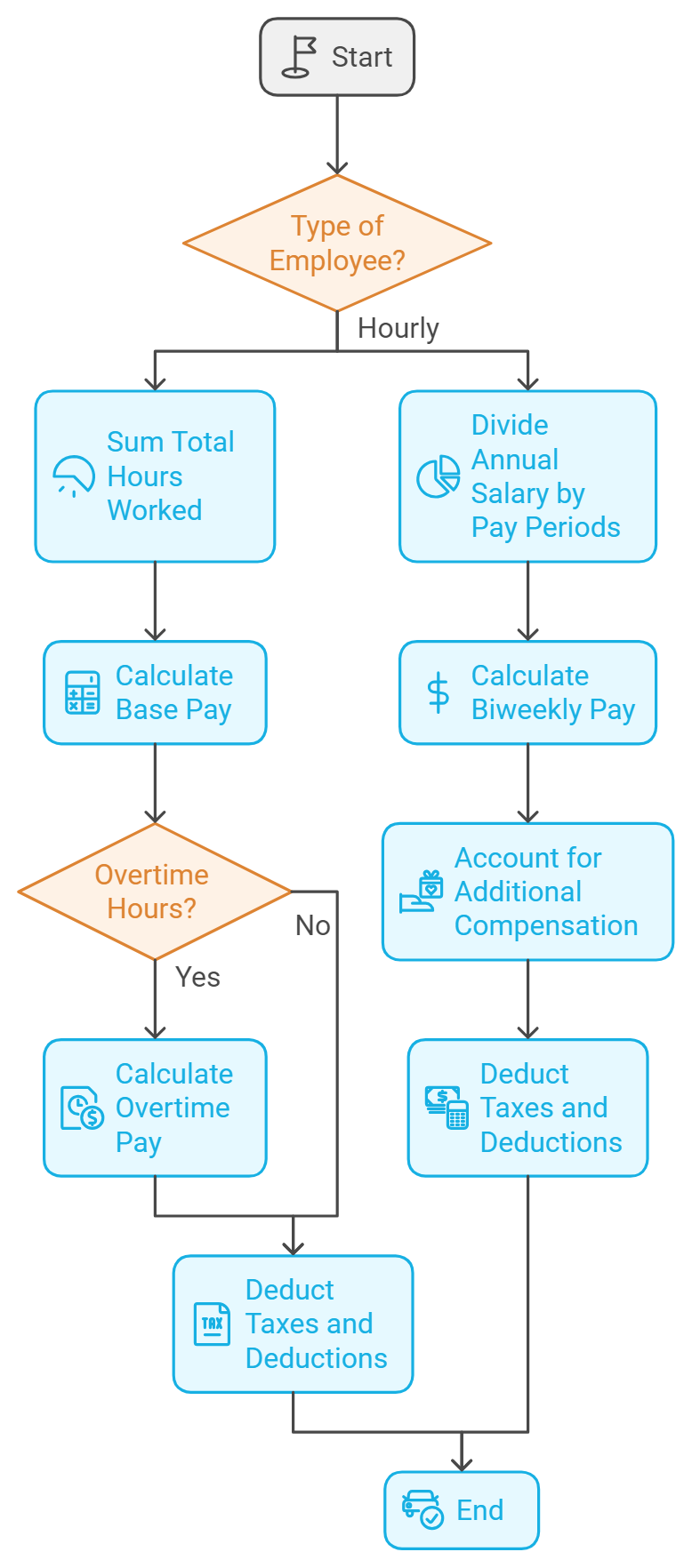

How To Calculate Biweekly Pay

For hourly workers, start by summing up the total hours they have worked over the past two weeks. Multiply this total by the employee’s hourly wage to determine their base pay. If overtime hours were worked, calculate these separately using the appropriate overtime pay rate, usually time and a half. After establishing the total pay, deduct payroll taxes and any other necessary deductions.

For salaried employees, the process involves taking the employee’s annual salary and dividing it by the number of pay periods in the year, which is typically 26 for biweekly payrolls. This will give you the biweekly pay amount. In addition to this calculation, remember to account for holiday pay, bonuses, and any other forms of compensation. Apply all applicable taxes and deductions to the final amount.

Both methods require careful attention to detail, ensuring that your calculations account for variations in hours worked and any additional earnings or withholdings.

Creating a supportive work environment not only involves timely payments and scheduling but also extends to offering programs that prioritize employee health and overall well-being.

Legal and Compliance Issues

Federal Fair Labor Standards Act

The Federal Labor Standards Act in the U.S. sets the ground rules for minimum wage, overtime, and accurate recordkeeping. Even when using a biweekly payroll system, you must calculate overtime weekly.

Non-exempt employees must receive overtime pay at a rate of one and a half times their regular earnings for any hours worked beyond 40 each week. Keeping precise records of hours worked ensures compliance and helps protect employees from wage violations.

Wage and Hour Regulations

Both federal and state laws determine how payments, breaks, and work hours are managed. While federal laws create a baseline, states can impose additional rules. For example, states like Connecticut, Massachusetts, and Michigan require weekly pay schedules.

Compliance is crucial not only for payment frequency but also for other benefits related to hours worked, leave entitlements and breaks. Failure to adhere to these standards can result in penalties, so ensure your payroll system respects both federal and state mandates.

- Biweekly or twice a month in most states

- Weekly in some states like Connecticut and Massachusetts

Recordkeeping Duties

Maintaining organized and complete records is essential. You’re mandated to keep detailed records of all hours worked and wages paid for at least three years. Specific timekeeping records, such as time cards, need to be preserved for a minimum of two years. Utilizing digital tools like electronic time clocks for real-time tracking can ease compliance and enhance accuracy.

- Keep wage and hour records: minimum of three years

- Maintain time cards: minimum two years

Investing in comprehensive document management software also helps ensure that your records comply with employment laws. Such tools enable secure storage and convenient access to employee information, aligning with acts like the Family Medical Leave Act and the Fair Labor Standards Act. With these solutions, you can manage your recordkeeping processes effectively, keeping all data accessible and compliant with legal obligations.

Effective Strategies for Managing Biweekly Pay

When implementing a biweekly pay system, careful planning is essential to ensure its success.

- Invest in reliable payroll software. Choose software that not only handles biweekly pay schedules but also easily integrates with time-tracking and accounting systems, allowing for smooth data exchange and accurate payroll management.

- Keep detailed records. It is vital to maintain accurate records of hours worked, wages, and any changes or corrections. This helps meet Fair Labor Standards Act (FLSA) compliance and quickly addresses any payroll discrepancies.

- Communicate with your employees. Inform them ahead of time about the transition to a biweekly pay schedule. Ensure they understand the pay changes and provide resources to help them interpret their paychecks and resolve any questions.

- Automate tax calculations and deductions. Using payroll software for automatic tax computation and deduction reduces errors. Be diligent in withholding and reporting federal, state, and local taxes.

- Conduct payroll audits regularly. Frequent audits help in spotting and correcting payroll errors, and preventing overpayments, underpayments, and compliance issues.

- Support your employees. Establish a dedicated support system for addressing any payroll-related concerns. This might involve HR team members or a self-service portal to provide necessary guidance.

- Plan for cash flow. Ensure your business consistently meets payroll obligations by securing sufficient cash flow. You may need to allocate specific funds for payroll to avoid any disruptions.

These strategies foster a smooth and efficient biweekly payroll process, aiding both employers and employees in navigating this schedule effectively while minimizing potential issues